Increase your future income

At SuisseRock we understand the importance of low and transparent charges in order to maximise the growth of our clients pension capital. In addition what investments we select play a crucial role in ensuring your pension capital keeps up with or out performs inflation.

No matter what your risk profile might be we tailor our portfolios around your personal objectives, goals and desires. We utilise low cost ETF’s (exchange traded funds) to keep costs to a minimum and overlay active management which allows us to increase cash exposure in times of increased volatility, realise/protect gains and deploy cash when opportunities present themselves.

Try our FREE risk profiling tool

Great performance

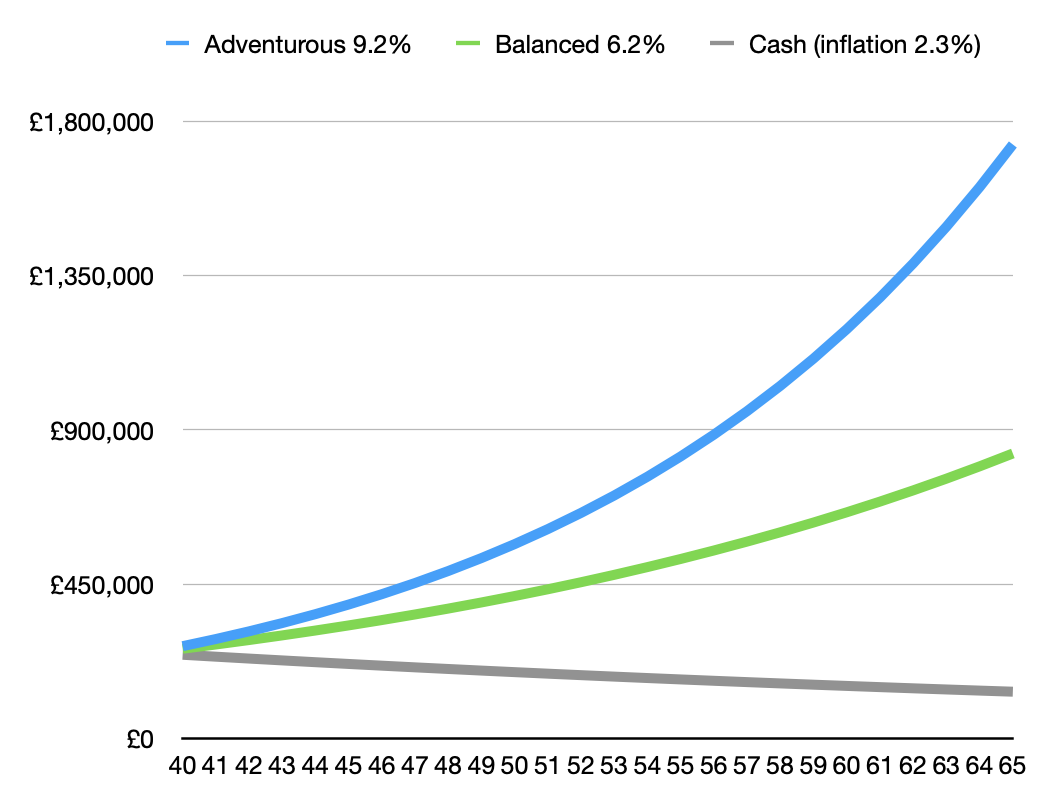

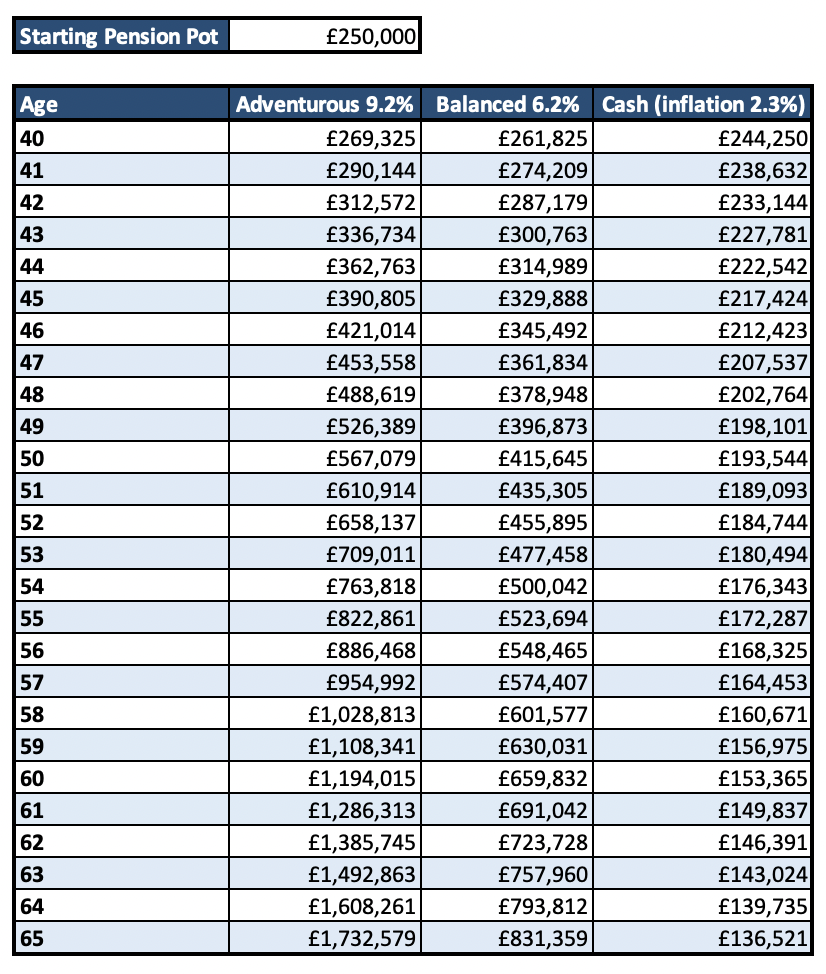

This strategy enables us to achieve an average annual return of 9.2% for our adventurous clients and a healthy 6.2% for our more conservative clients. The below table illustrates the impact of compound growth and a pension worth £250,000 today could be worth £1,732,579 in 25 years time. In addition it also highlights how your buying power is significantly reduced by inflation if you do nothing.

Low annual fees

In addition to great performance our fee structures are extremely competitive with an annual TER of approximately 1.47% which includes annual trustee fees, fund platform, investment underlying assets and active management including quarterly and ad hoc reviews.

Free UK pension health check

If you are a member of a UK pension and would like to check if your assets are being optimised then please feel free to schedule your FREE UK pension health check.

Simply click on the calendar below and select a convenient time and date to meet with one of our qualified advisors over Teams.

Alternatively you can complete the below form and one of our team will call you back and discuss your options over the phone.