With the rapid increase to the cost of living across Europe many people are starting to be concerned and quite rightly so. Whilst interest rates have also increased there is still a significant disparity between the two.

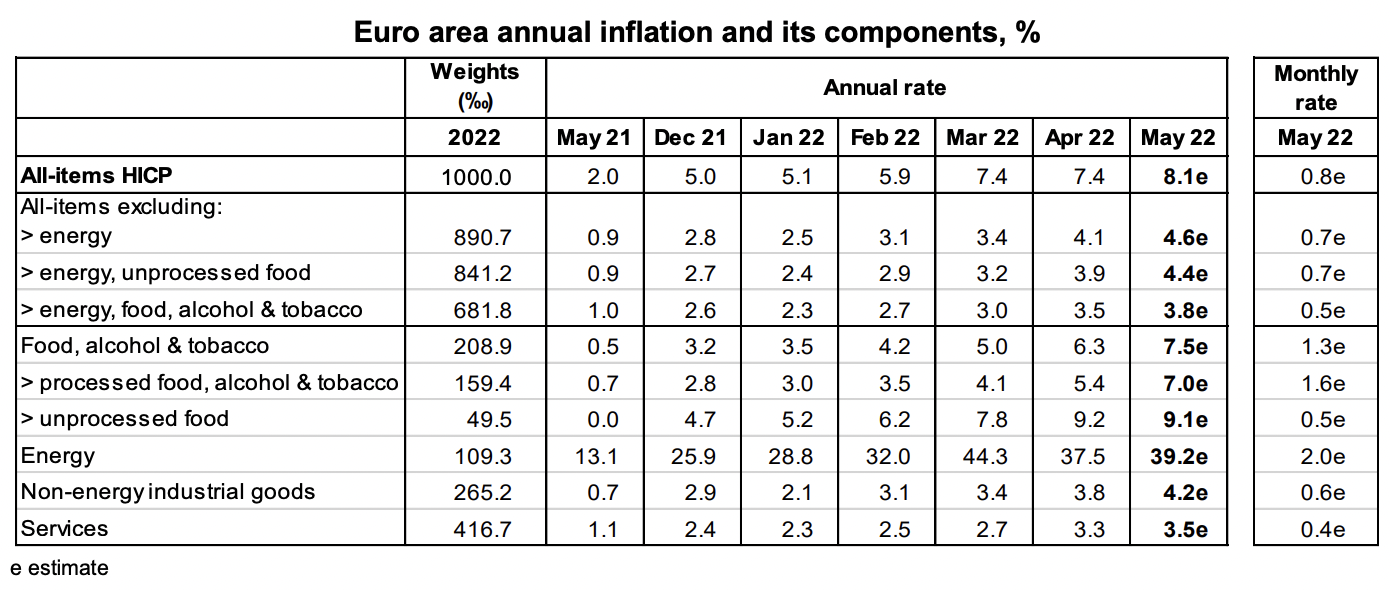

Inflation across Europe reached a staggering 8.1% in May. whilst interest rates remain below 1%.

So how can we combat inflation?

It is extremely important that our savings and pensions are rising in line with inflation and if possible at a greater rate. You do not need to be an experienced day trader or investor in order to make your capital grow in a steady and cautious manner. All you need to do is commit to a disciplined strategy with very little input required by yourself.

Disciplined Regular Saving

We have written many articles about this topic before but it seems more prudent now to re-address it and highlight the benefits to our followers and clients.

With market volatility making it even harder to predict where to invest your capital, investing on a regular basis takes out the guessing work. By saving a fixed amount per month over the medium to long term you can benefit from the rise and falls of the market and mitigate risk significantly. Whether you are saving for retirement, your children’s education, a new home or even just a rainy day fund you can benefit from inflation beating returns with a unit cost averaging strategy.

Unit Cost Averaging

Unit cost averaging is a strategy where an investor buys into the stock market on a regular monthly/quarterly basis no matter what the market is doing. Deploying this approach will mean you buy units when the market price is at its high, lows and any where in-between. Over the long term this strategy has proven that you will obtain more units and therefore a greater return.

More detailed information can be found here!

Compound Interest

If I told you that your growth/interest could earn additional interest this would be of interest wouldn’t it? Well this is exactly what Compound interest is and does.

Compounded interest is the interest earned on interest. Compounded interest leads to a substantial growth of your investments over time. Hence, even a smaller initial investment amount can fetch you higher wealth accumulation provided you have a longer investment horizon of say five years or more.

Reduce Income Taxes

In Switzerland there are solutions that enable you to save/invest on a regular basis and also benefit from tax relief by doing so. So not only can you benefit from reduced market risk and compound interest you can also claim tax relief each year and reinvest this capital also should you wish in order to help your portfolio grow even further.

What To Do Next

If this is of interest to you please feel free to leave your details below and one of our advisors will contact you as soon as they are able to arrange a convenient time to meet with you and explore your options.