With the travel sector yet to open due to global travel restrictions, there is still a great opportunity to invest in a struggling sector. Previously we created a bespoke investment around the Aviation theme. On this occasion we have included four well known travel based companies.

At SuisseRock our focus is always around wealth preservation and as a result we include protection within our portfolios as much as possible. Our latest offering includes a healthy return of 18% per annum and offers significant capital protection of 50%.

Investment Details

Issuing Bank = BBVA

Underlying Stocks = Hilton Worldwide, Airbnb, Expedia Group and Norwegian Cruise Line

Defined Return = 4.5% per quarter (18% PA)

Capital Protection Barrier = 50%

Autocall/Income Trigger = 100% of initial level, then reducing by 2.5% every quarter

Maximum Term = 4 years

How It Works

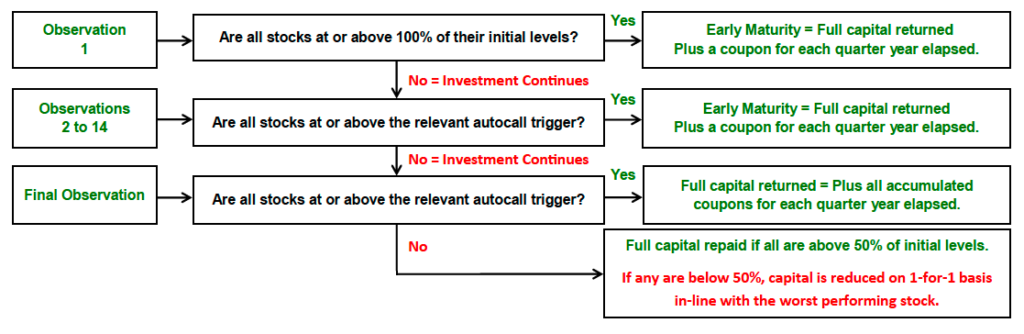

At the strike date the levels of the four above stocks are recorded and locked in. Then after 6 months if all four stocks are at or above 100% of their initial level you will receive 100% of your initial investment back plus 2 x 4.5% (9%). If one stock is below the autocall level the investment continues for a maximum term of 4 years with quarterly observations.

After 6 months each quarterly observation level is reduced by 2.5%. Therefore, increasing the opportunity of an early maturity. At the final observation date (after 4 years) the autocall/income trigger is just 65%. So providing all four stocks are within 65% of their initial level you will receive 100% of your initial investment back plus 4 x 18% equalling a 72% return. However, we do anticipate this investment maturing within the first 24 month period.

For more information about this investment and other available protected opportunities please feel free to contact us. Simply complete the below form and one of our advisors will contact you.